Conducting a Transfer Pricing Trial

by Dr Daniel N Erasmus

Key Learning Points

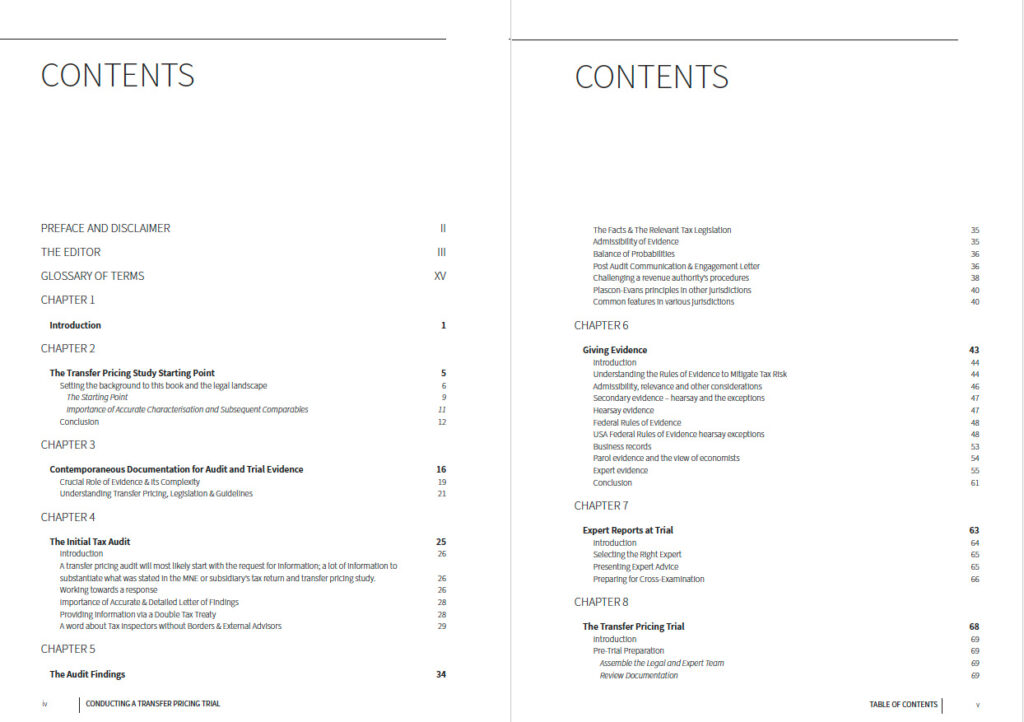

The Transfer Pricing Study Starting Point & The Initial Problems

The Initial Tax Audit & The Audit Findings

The Letter of Findings & The Objection & Appeal

Pleadings/ How to manage the Trial Process / Preparing the Evidence

Heads of Argument & The Trial

Appeals

Purchase now for US$ 99.00 (50% off)

If you order the book NOW (LIMITED TIME ONLY) you will get it for only US$99.00. The book comes with a 100% guarantee: if you don’t like what you read, you’ll get your money back.

Pre-Launch Price $ 99.00

If you pre-order now.

That is 50% off the list price

We will also include:

a FREE copy of Tax Intelligence: The 7 Habitual Tax Mistakes Made by Companies – 2nd Ed (by Dr Daniel N. Erasmus).